Calculate commissions for any insurance product

Take a tour of AgencyComp

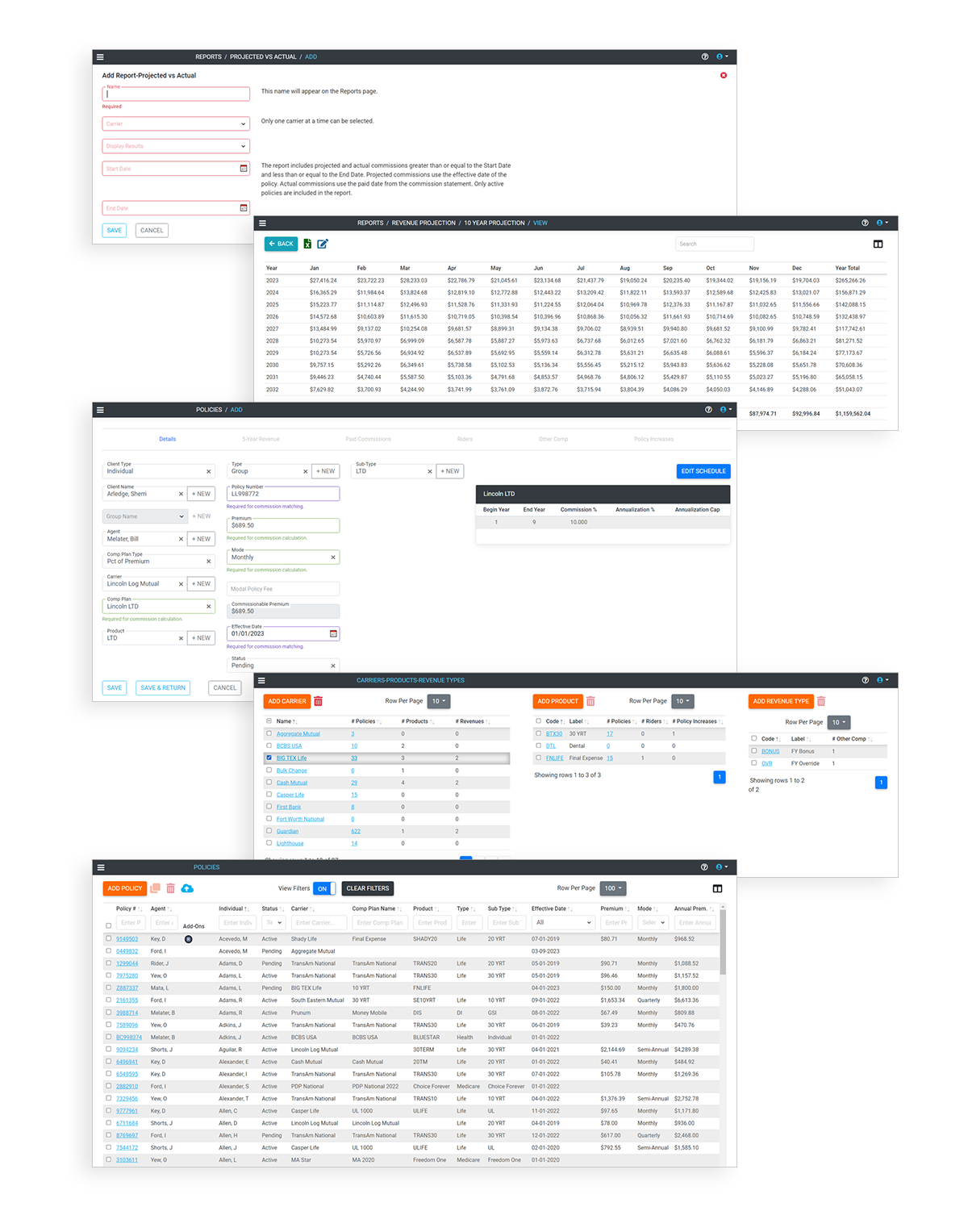

Check all the powerful tools AgencyComp puts at your fingertips.

Track your commissions in six easy steps

Commission tracking with AgencyComp is just a few short steps away. Our knowledge base is filled with videos and step-by-step instructions that will have you tracking your commissions in no time at all.

Add your carriers and compensation plans

Carriers are the companies you represent. A compensation plan describes how commissions are paid on a policy.

Import your client policies

AgencyComp provides import templates for Percentage of Premium, Medicare Advantage, Fee, Target Premium, and Graded policies

Create an import map for each carrier

A map provides a diagram of which fields are imported from the commission statement

Import your commission statements

Statements in Excel can be quickly imported

Post commissions to policies

Posting is the process of linking a commission to a policy

Add reports

There are six reports to help track your commissions

Flexible enough to calculate and track commissions for virtually any product

Unlike most commission trackers, AgencyComp does not require you to purchase an expensive CRM with features you don’t need or use. With minimal data, you can calculate, project, and identify missing or inaccurate commissions. AgencyComp can calculate commissions for almost any type of policy.

Commissions can even be calculated and tracked for complicated commission plans. Our Medicare Advantage and Prescription Drug Plan compensation module does not require lengthy setups for policies paying at different effective dates. We have consulted with Medicare experts to develop a quick and easy module that can track these commissions for any enrollment type or effective date.

Target Premium commissions can be difficult to calculate because of the many variables associated with the policy. Our target premium commission module accounts for any lump sum or 1035 exchange amount, number of years premiums are paid and target premium amount. The commission schedule can accept any target premium commission period and any renewal period.

Percentage of Premium

- Term Life

- Medicare Supplement

- Final Expense

- Disability

- Long Term Care

- Annuity

- Medical

- Voluntary Benefits

Medicare Advantage

- Medicare Advantage

- Prescription Drug Plans

Fee

- Individual Health

- Group Health

Target Premium

- Universal Life

- Whole Life

Graded

- LTD

- STD

- Life

- AD&D

- Dental

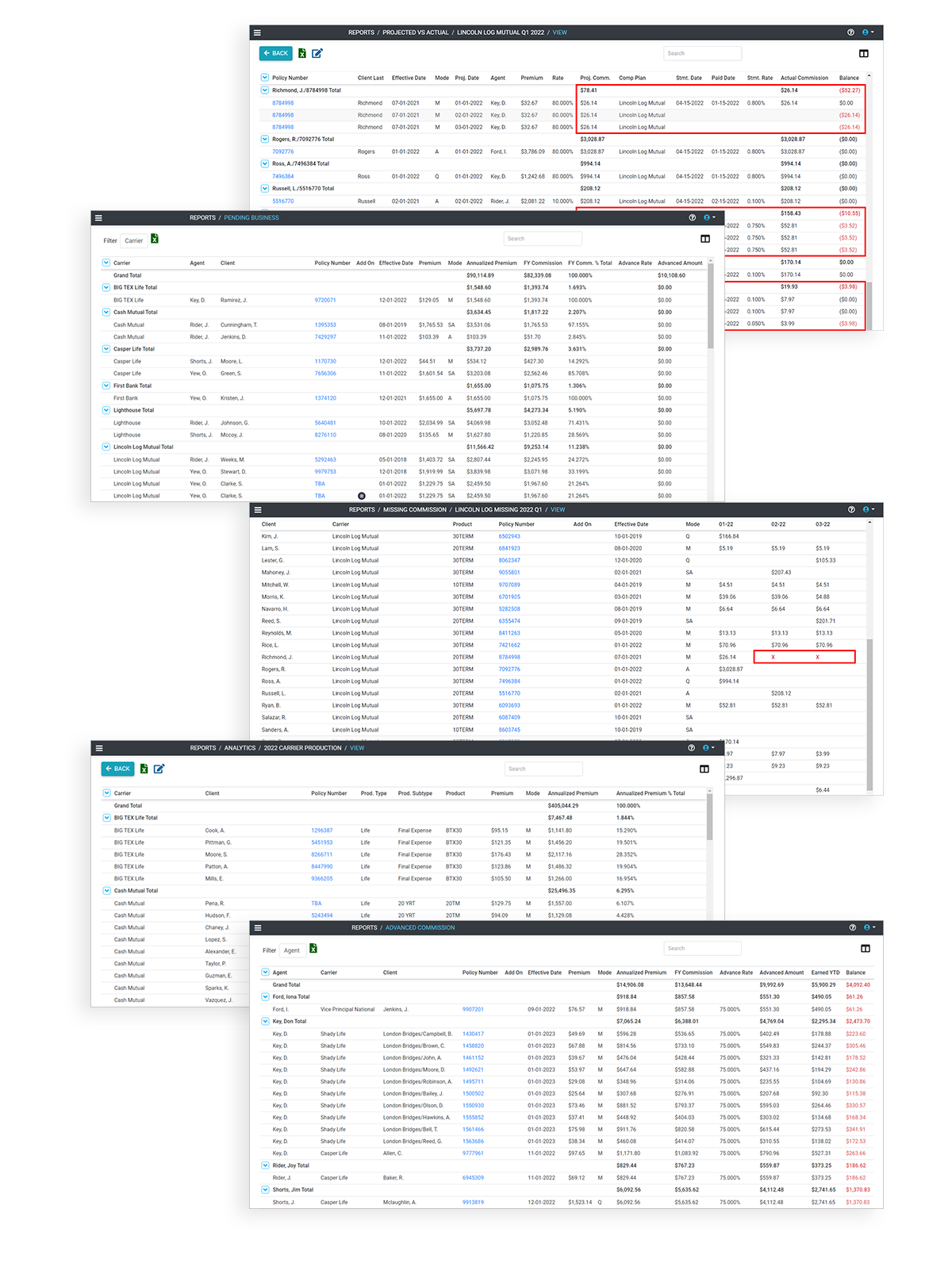

Our robust reports include:

These valuable reports can help you understand where your commissions are derived, allowing you to spend more time where you are most profitable.

Pending Business

View first year commissions on policies in underwriting

Analytics

Analyze your book of business by premium or commission

Revenue Projection

Project revenues up to 10 years

Projected vs Actual

Compare expected commissions to those received

Missing Commission

12-month lookback on commissions received and missed

Advanced Commission

Determine any debit balance for policies with advanced commissions

Goals

Set premium and commission goals and track them over a specific period

Your data is secure

100% cloud-based, so you can log in from anywhere

Secured by Amazon Web Services (AWS)